Introduction

Investing in the Nifty 50 Index Fund is a reliable way to gain exposure to India’s top-performing companies. This fund tracks the performance of the Nifty 50 Index, a benchmark index comprising 50 of the largest and most liquid stocks listed on the National Stock Exchange (NSE).

“For new and experienced investors alike, understanding how this fund works can pave the way for sustainable financial growth.”

Some of the top Nifty 50 index funds include Kotak Nifty 50 Index Fund, DSP Nifty 50 Index Fund, UTI Nifty 50 Index Fund, ICICI Prudential Nifty 50 Index Fund, and SBI Nifty 50 Index Fund.

Key Takeaway

Investing in the Nifty 50 Index Fund offers a blend of stability, diversification, and growth potential. Here are five key points to remember:

- It tracks the performance of India’s top 50 companies across various sectors.

- The low-cost structure makes it ideal for long-term investors.

- Diversification reduces the risk of individual stock performance.

- SIPs make investing accessible for all budgets.

- It’s a passive investment strategy that aligns with market performance.

What is the Nifty 50 Index Fund?

The Nifty 50 Index Fund is a passive mutual fund that replicates the Nifty 50 Index.

Unlike actively managed funds, this fund mirrors the performance of the index by investing in all 50 constituent stocks in the same proportion.

The low-cost structure of this fund is one of its major advantages, as it involves minimal management fees. By investing in this fund, you can achieve broad market exposure while minimizing risks associated with individual stock selection.

Why Choose a Nifty 50 Index Fund?

- Diversification:

The Nifty 50 Index Fund offers exposure to a diverse range of sectors such as IT, finance, healthcare, and consumer goods. This diversification reduces the risk of over-reliance on any single sector. - Cost Efficiency:

Since it’s a passively managed fund, the expense ratio is considerably lower compared to actively managed funds, ensuring that more of your returns stay intact. - Consistent Performance:

Historically, the Nifty 50 Index has delivered steady returns over the years, reflecting the overall performance of the Indian economy. - Ease of Investment:

With systematic investment plans (SIPs), investing in a Nifty 50 Index Fund is simple and convenient, catering to both small and large investors.

How Does the Nifty 50 Index Fund Work?

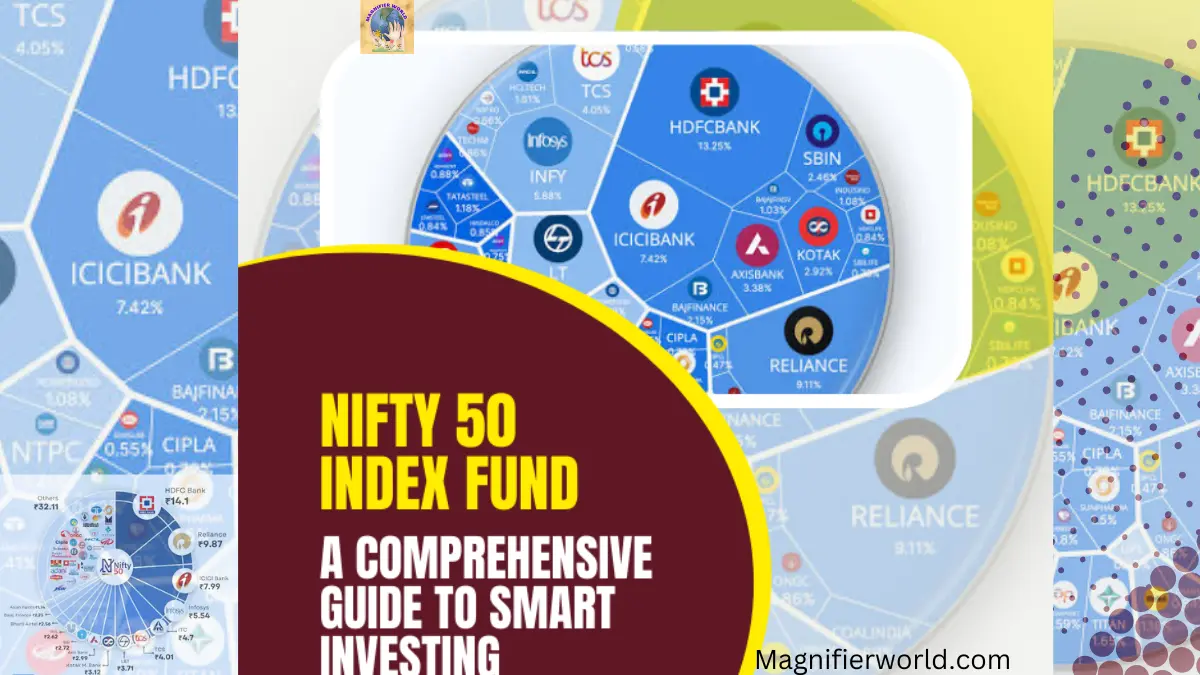

This fund invests in the same companies listed in the Nifty 50 Index, adhering to their exact weightage.

To understand what is the Nifty 50 Index Fund, you need to know it invests in the top 50 companies listed on the Nifty index. For example, if a company constitutes 10% of the Nifty 50 Index, the fund allocates the same percentage to that stock.

As the index value rises or falls, the fund’s value adjusts accordingly. This simple structure makes it an attractive choice for those looking to invest with minimal oversight.

This fund replicates the performance of the Nifty 50 Index, a benchmark that reflects the broader Indian economy. By investing in this fund, you diversify your portfolio across multiple industries and reduce risk through exposure to large-cap stocks.

Its passive nature makes it a cost-effective choice for beginners and seasoned investors alike. With the growth of India’s economy, this fund is poised to provide long-term returns.

Key Features of the Nifty 50 Index Fund

Diversification for Stability

The Nifty 50 Index Fund includes companies from sectors such as technology, finance, energy, and healthcare, ensuring broad exposure to the economy.

This diversification minimizes risks, as losses in one sector can be balanced by gains in another. For instance, while financial stocks may face challenges during economic downturns, defensive sectors like healthcare often maintain stability.

Cost Efficiency

A primary advantage of this fund is its low expense ratio, which results from its passive management strategy. Unlike actively managed funds, the Nifty 50 Index Fund doesn’t require frequent trading or market speculation, significantly reducing operational costs.

When asking what is the Nifty 50 Index Fund, it’s essential to recognize its role in providing diversification across key sectors. This cost efficiency ensures that more of your money is invested rather than lost to fees, maximizing overall returns.

Best Nifty 50 Index Funds (2025)

d:

- Kotak Nifty 50 Index Fund: This fund is designed to mirror the performance of the Nifty 50 index, making it a good option for long-term investors looking for market returns. Kotak Nifty 50 Index Fund has a strong reputation in the investment space and offers competitive expense ratios.

The Kotak Nifty 50 Index Fund aims to replicate the performance of the Nifty 50 index, providing investors with exposure to India’s top 50 companies.

- DSP Nifty 50 Index Fund: Managed by dsp nifty 50 index fund, this index fund provides investors exposure to India’s top 50 companies, helping to diversify risk and track the Nifty 50 index with minimal tracking error.

The DSP Nifty 50 Index Fund aims to replicate the performance of the Nifty 50 index, providing investors with exposure to India’s top 50 companies at a low-cost structure.

- UTI Nifty 50 Index Fund: Managed by UTI Asset Management Company, UTI Nifty 50 Index Fund aims to replicate the performance of the Nifty 50 index and offers a good option for low-cost, passive investment in large-cap stocks.

The UTI Nifty 50 Index Fund is designed to track the performance of the Nifty 50 index, providing investors with exposure to the top 50 companies listed on the National Stock Exchange (NSE).

- ICICI Prudential Nifty 50 Index Fund: Known for its reliable fund management, this index fund aims to replicate the performance of the Nifty 50 index, making it a stable option for investors looking for broad market exposure.

- SBI Nifty 50 Index Fund: Managed by SBI Mutual Fund, this fund tracks the Nifty 50 index and is well-regarded for its consistent returns and low expense ratios, making it accessible to a wide range of investors.

Benefits of Investing in the Nifty 50 Index Fund

Steady Long-Term Returns

Explaining what is the Nifty 50 Index Fund involves detailing its structure, which replicates the Nifty 50 benchmark for consistent returns.

The Nifty 50 Index has consistently delivered strong performance over the years, making this fund a reliable choice for long-term investors. Its returns mirror the index, ensuring alignment with India’s economic trajectory.

For those looking to grow their wealth steadily, staying invested in this fund over a decade or more is a proven strategy.

High Liquidity and Accessibility

Investing in the Nifty 50 Index Fund is simple and highly liquid. Investors can easily buy or sell units without worrying about market demand or pricing.

This accessibility makes it an attractive option for both first-time investors and those seeking to adjust their portfolios dynamically based on market conditions.

Understanding the Nifty 50 Index Fund

The Nifty 50 meaning refers to an index representing the top 50 companies listed on the National Stock Exchange of India.

The Nifty 50 Index Fund is a passive investment instrument that mirrors the performance of the Nifty 50 Index, which represents India’s top 50 companies across diverse sectors.

This fund provides exposure to large-cap stocks, offering a stable and reliable investment option. By investing in this fund, you gain access to the country’s economic growth, ensuring steady returns over time.

Its passive nature eliminates the need for constant market tracking, making it ideal for beginners and seasoned investors alike.

For beginners in investing, exploring the Nifty 50 meaning can provide insights into diversified and stable investment options.

The fund is recognized for its cost efficiency due to lower management fees, making it a preferred choice for those looking for long-term wealth creation.

The Advantages of Nifty 50 Index Fund

Investing in the Nifty 50 Index Fund offers numerous benefits, starting with diversification. The index spans multiple sectors, including finance, technology, healthcare, and energy, reducing the impact of a downturn in any single industry.

This broad-based exposure ensures that your portfolio remains balanced, even during volatile market phases.

Another significant advantage is the fund’s low expense ratio, which means a larger portion of your investment works for you rather than being consumed by fees.

Additionally, its passive management style ensures that it mirrors the index’s performance closely, providing predictable returns over the years.

How Does the Nifty 50 Index Fund Work?

The Nifty 50 Index Fund works by replicating the composition and performance of the Nifty 50 Index. To understand how to invest in Nifty 50, you need to explore options like index funds, ETFs, or direct stock investments.

It invests in the same 50 companies listed in the index, maintaining the same weightage for each stock.

This ensures that the fund’s performance mirrors the market index. Investors benefit from the simplicity of this model, as there’s no active management involved. The absence of constant buying and selling reduces transaction costs, contributing to the fund’s cost efficiency.

Furthermore, since the Nifty 50 Index comprises companies with a proven track record, investors are assured of quality and stability in their portfolio.

Challenges in Investing in Nifty 50 Index Fund

While the Nifty 50 Index Fund is an excellent investment option, it’s not without challenges. One notable drawback is its dependence on market conditions.

During economic downturns or bear markets, the index may decline, directly impacting the fund’s performance. Additionally, the fund’s passive nature means there’s no active strategy to mitigate risks during market volatility.

Another limitation is the lack of customization, as investors cannot choose specific sectors or stocks to include in their portfolio.

Despite these challenges, the fund remains a favorable choice for those with a long-term perspective and a moderate risk tolerance.

Who Should Invest in the Nifty 50 Index Fund?

The Nifty 50 Index Fund is suitable for a broad range of investors. Beginners can benefit from its simplicity, while experienced investors can use it to diversify their portfolios.

It’s particularly ideal for those with a long-term investment horizon, as the fund’s steady growth aligns well with wealth creation goals.

Additionally, individuals seeking low-cost investment options will find the fund appealing due to its minimal expense ratio.

However, those with a higher risk appetite or interest in active trading may find this fund less exciting, as it doesn’t involve speculative or high-growth opportunities.

Read More:-Mutual fund and stock market: which is better?

The Role of Nifty 50 in Long-Term Planning

The Nifty 50 Index Fund plays a crucial role in long-term financial planning. Its alignment with the top-performing companies ensures consistent returns, making it an excellent tool for wealth accumulation.

Over a decade or more, the fund’s performance has historically matched or outperformed other investment avenues with similar risk profiles.

By holding onto the fund during market fluctuations, investors can benefit from the power of compounding, which significantly boosts returns over time.

This makes it an attractive option for retirement planning and achieving other life goals like funding education or buying property.

The Nifty 50 Index Fund is a cornerstone investment option for individuals looking to grow their wealth steadily and securely. Its passive nature, low costs, and alignment with India’s economic growth make it a reliable choice.

While it may not suit those seeking high-risk, high-reward opportunities, its simplicity and consistency are unmatched.

By integrating the Nifty 50 Index Fund into your portfolio, you ensure diversification, cost efficiency, and exposure to India’s economic potential, making it a valuable addition to any investment strategy.

How to Start Investing

Choosing the Right Fund

If you’re wondering how to invest in Nifty 50 index fund, consider opening a demat account and selecting a fund that mirrors the index.

Several fund houses offer Nifty 50 Index Funds. Research is crucial to select a fund with a low expense ratio and minimal tracking error.

These factors ensure that the fund closely follows the Nifty 50 Index’s performance, maximizing potential returns while keeping costs in check.

ZFunds

Investment Methods: SIP or Lump Sum

Depending on your financial situation, you can invest via a Systematic Investment Plan (SIP) or a lump sum.

SIPs are ideal for those wanting to invest small amounts consistently, while a lump sum suits investors with larger capital ready for deployment. Both approaches have their merits and can be tailored to individual goals.

Read More:-Top 10 Recommended Mutual Funds for SIP Investments in 2024

Challenges to Consider

Market Dependency

Since the Nifty 50 Index Fund mirrors the index, its performance is tied to market conditions. During bear markets, the fund’s value may drop, making it unsuitable for investors with a low risk tolerance.

However, such downturns are often temporary and can be mitigated with long-term investment horizons.

Limited Customization

Unlike actively managed funds, investors in the Nifty 50 Index Fund cannot choose specific stocks or sectors.

This lack of customization may not appeal to those with specific investment preferences, such as focusing on green energy or tech startups.

- The Nifty 50 Index Fund offers exposure to India’s top 50 companies.

- Its low expense ratio makes it cost-effective for all investors.

- SIPs allow gradual investment, while lump sums cater to those with higher initial capital.

- Diversification across sectors minimizes risks.

- It’s a reliable tool for long-term wealth creation.

The Nifty 50 Index Fund is a straightforward and effective investment vehicle for anyone looking to grow their wealth over time.

Its alignment with India’s economic growth and low management costs make it ideal for long-term financial goals.

Whether you’re a new investor or an experienced one, this fund provides stability, transparency, and a balanced risk-reward ratio.

How to Start Investing in the Nifty 50 Index Fund?

- Choose a Fund Provider:

Various mutual fund houses offer Nifty 50 Index Funds. Research their expense ratios, tracking error, and reputation before making a choice. - Select an Investment Mode:

Decide between a lump-sum investment or a systematic investment plan (SIP). SIPs are ideal for building wealth gradually with smaller contributions. - Monitor Performance:

Regularly review the fund’s performance against its benchmark to ensure it aligns with your financial goals.

Conclusion

The Nifty 50 Index Fund is an excellent investment vehicle for individuals seeking a low-risk, high-reward opportunity to invest in India’s top-performing companies.

Its simplicity, cost efficiency, and long-term growth potential make it a preferred choice for seasoned and novice investors alike.

By diversifying your portfolio through this fund, you can participate in India’s economic growth while minimizing financial risks.

FAQs About the Nifty 50 Index Fund:

- What is the minimum investment required for the Nifty 50 Index Fund?

Most funds allow a minimum SIP amount of ₹500, making it accessible to all investors.

- Are the returns from the Nifty 50 Index Fund taxable?

Yes, the returns are subject to capital gains tax depending on the holding period.

- How do I select the best Nifty 50 Index Fund?

Look at factors like expense ratio, tracking error, and fund manager reputation.