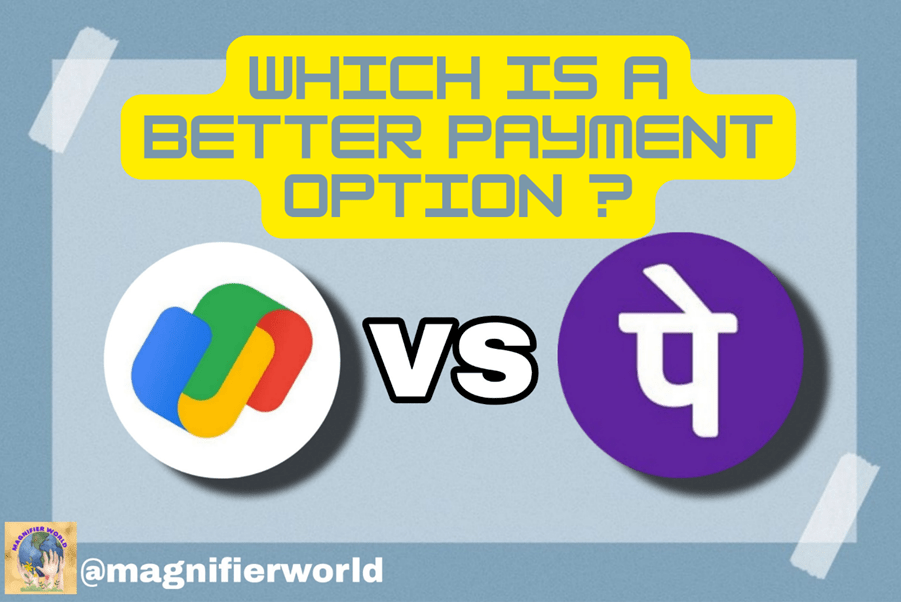

Introduction – Difference Between Phonepe and google pay: Mobile Payment

In this article, we are going to understand the difference between Phonepe and google pay. Mobile payment solutions have gained popularity around the globe as a result of the growth of digital payments.

In this market, Phon Pe and Google Pay are two well-known competitors. These platforms provide simple and safe solutions for users of mobile devices to conduct transactions.

We will examine the features, user interfaces, security features, and services that Phon Pe and Google Pay offer as well as how they vary in this post. Users may select the platform that best meets their needs by being informed about these variances.

1. Background and Overview-Difference Between Phonepe and google pay

The first factor to consider while understanding the difference between Phonepe and google pay is background and overview.

“Both Phonepe and Google Pay are mobile payment systems that let users conduct a range of financial transactions including peer-to-peer transfers, utility bill payments, online buying, and more. Phonepe was released in India in 2015 and swiftly acquired popularity, fast moving to the top of the market.”

Google Pay, on the other hand, was unveiled in 2015 as well, but globally. It seeks to give consumers everywhere a smooth payment experience and is a component of Google’s larger ecosystem.

2. User Interface and Experience-Difference Between Phonepe and google pay

The second factor to consider while understanding the difference between Phonepe and google pay is user interface and experience. The way that PhonPe and Google Pay’s user interfaces and experiences are different from one another is one of the main distinctions.

PhonPe is a simple and user-friendly UI that focuses on giving a simplified payment experience. The design of the app is clean and user-friendly, making it simple for users to browse through the many functions.

Google Pay, on the other hand, adheres to Google’s Material Design principles, providing a visually beautiful and coherent experience. It connects effectively with other Google services, allowing consumers to effortlessly access their payment information.

3. Availability and Reach-Difference Between Phonepe and google pay

The third factor to consider while understanding the difference between Phonepe and google pay is availability and reach.

- While PhonPe primarily caters to the Indian market, Google Pay has a global presence. PhonPe’s administrations are as of now constrained to India, permitting clients to transact in Indian Rupees (INR).

- Google Pay, on the other hand, bolsters exchanges in numerous monetary forms and is accessible in a few nations around the world, counting the United States, Canada, and the United Kingdom.

The broader accessibility of Google Pay makes it a helpful choice for clients who regularly travel or conduct cross-border transactions.

4. Integration and Ecosystem-Difference Between Phonepe and google pay

The fourth factor to consider while understanding the difference between Phonepe and google pay is integration and ecosystem. Google Pay benefits from its integration with Google’s broader ecosystem.

It interacts easily with other Google services, including Gmail and Google Contacts, making it simple to send money or make payments to contacts kept on these platforms. Google Pay also connects with Google Assistant, allowing users to conduct transactions via voice requests.

PhonPe, while not as deeply integrated into an extensive ecosystem, offers integration with various popular apps and services within India. This integration allows users to make payments directly through partner apps and websites.

5. Security Measures – Difference Between Phonepe and google pay

The fifth factor to consider while understanding the difference between Phonepe and google pay is security measures. Both Phonpe and Google Pay prioritize the security of user transactions.

PhonPe employs a multi-layered security approach, including the use of encrypted data transmission, secure PIN authentication, and two-factor authentication for certain transactions. It also offers an option for setting transaction limits and enables users to remotely log out of their accounts.

Additionally, Google Pay leverages different security layers, counting encryption and tokenization, to secure client information. It moreover permits clients to set up a screen lock on their gadgets to secure their instalment data.

6. Additional Features and Services

The sixth factor to consider while understanding the difference between Phonepe and google pay is additional features and services. PhonPe and Google Pay offer additional features and services that differentiate them from each other.

PhonPe offers a variety of value-added services like mobile phone recharging, utility bill payment, mutual fund investment, and insurance policy purchase. It also has a digital wallet where users may save their money and conduct rapid transactions.

Google Pay, on the other hand, has features such as bill splitting among friends, the ability to request and transfer money using QR codes, and reward programme interfaces. It also includes “Google Pay for Business,” which allows small companies to accept digital payments via the app.

“Both Phonpe and Google Pay offer rewards and cashback programs to incentivize users to make transactions through their platforms. PhonPe’s “PhonPe Rewards” program allows users to earn cashback on various transactions, including mobile recharges, bill payments, and online shopping”.

The cashback can be redeemed for future transactions or transferred to a user’s bank account. Google Pay offers a similar program called “Google Pay Rewards,” where users can earn scratch cards or cashback on qualifying transactions. These rewards can be used for subsequent transactions or redeemed for cash.

7. Merchant Acceptance and Integration

The seventh factor to consider while understanding the difference between Phonepe and google pay merchant acceptance and integration. PhonPe and Google Pay both focus on expanding their merchant acceptance networks to facilitate seamless transactions for users.

- PhonPe has partnered with a wide range of online and offline merchants in India, enabling users to make payments at various establishments. It also provides a QR code-based payment solution for small businesses.

- Google Pay has a growing network of merchants globally, and its integration with Google’s ecosystem allows for smooth transactions within popular apps and websites.

8. Customer Support and Assistance

The eighth factor to consider while understanding the difference between Phonepe and google pay is customer support and assistance. When it comes to customer support, both PhonPe and Google Pay offer assistance through their respective apps.

PhonPe provides a customer care helpline and an in-app chat feature where users can reach out for support. It also contains a comprehensive FAQ section that answers frequently asked questions.

Google Pay provides customer service via its Help Centre, where customers may get solutions to commonly asked issues. Furthermore, both systems feature active social media channels where users may interact and get updates.

Certainly! Here’s an additional point:

9. International Money Transfer

The ninth factor to consider while understanding the difference between Phonepe and google pay is international money transfer. One notable difference between PhonPe and Google Pay is their capability for international money transfers.

While PhonPe focuses primarily on domestic transactions within India, Google Pay offers the ability to send and receive money internationally.

Google Pay allows users in approved countries to move money across borders through agreements with various payment service providers, making it a handy choice for consumers with worldwide financial commitments or those who often engage in international transactions.

This functionality enhances Google Pay’s adaptability by allowing users to perform safe and easy cross-border transactions.

It should be noted that the availability and particular features of international money transfers may differ based on the user’s place of residency and the legislation governing such transactions.

It should be noted that the availability and particular features of international money transfers may differ based on the user’s place of residency and the legislation governing such transactions.

“Users interested in international money transfers should consult the official websites or support channels of PhonPe and Google Pay to determine the specific capabilities and requirements for cross-border transactions.”

Conclusion

In conclusion, PhonPe and Google Pay are prominent mobile payment platforms with unique features and offerings.

While PhonPe primarily serves the Indian market with its user-friendly interface and comprehensive range of services, Google Pay has a wider global reach and benefits from integration with Google’s ecosystem.

The choice between the two platforms depends on factors such as geographical location, preferred features, and the convenience of integration with other services. Both Phonpe and Google Pay prioritize security, offer rewards programs, and aim to provide a seamless user experience.

Understanding the differences between these platforms can help users make an informed decisions based on their specific needs and preferences. Thus concluded our article on the difference between Phonepe and google pay.

Mr Mobile